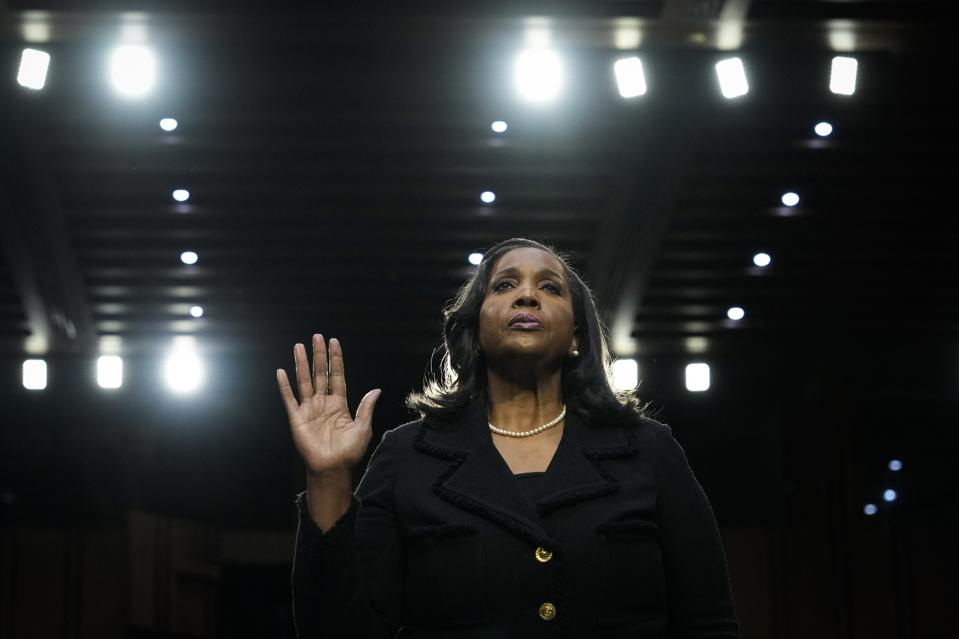

Federal Reserve Governor Lisa Cook at Senate Banking Committee swearing in.

Getty Images

One day after President Donald Trump’s unprecedented decision to fire Federal Reserve Governor Lisa Cook, the first Black woman to serve in the position in the Fed’s 111-year history, cryptocurrency markets are experiencing significant turbulence that validates concerns about the President’s unrelenting assault on the Fed’s statutorily empowered independence. The dollar’s strength weakened, as well.

Trump’s attempted removal of an independent Fed governor is also a first in the Fed’s history. Trump’s announced his attempt to remove Cook in a Truth Social letter posted Monday night, citing unsupported allegations about mortgage fraud allegations, which Cook and her legal team vehemently deny.

Immediate Market Impact: Crypto Flash Crash Wipes $100 Billion

The crypto market’s reaction has been swift and brutal. Bitcoin suffered what is being referred to as a “flash crash” that knocked $4,000 from the bitcoin price in minutes, with the digital asset dropping “under $110,000 per bitcoin for the first time since early July,” according to Forbes. The broader crypto market has reportedly lost approximately $100 billion from the combined $4 trillion crypto market in just 24 hours.

The Strategic Bitcoin Reserve Paradox

The irony is unavoidable: Trump’s attack on Fed independence threatens the very credibility that makes his Strategic Bitcoin Reserve valuable. In March 2025, Trump signed an executive order establishing the Strategic Bitcoin Reserve, designating Bitcoin as “digital gold” and creating a permanent reserve asset funded by Treasury’s forfeited bitcoin. The U.S. government is estimated to hold approximately 200,000-207,000 bitcoin, worth roughly $17 billion as of March 2025, making it the largest known state holder of bitcoin.

But this achievement depends fundamentally on institutional credibility that relies on Fed’s independence. The Strategic Bitcoin Reserve, for example, is designed to “meet governmental objectives” and serves as a “store of reserve assets of the United States”, functions that require the kind of monetary stability and institutional trust that Trump’s Fed interference directly undermines.

Why Markets Are Rejecting Trump’s Fed Power Grab

The crypto market’s negative reaction reflects growing concerns about Trump’s escalating attacks on Fed independence, which come on top of his unrelenting assault on Fed Chair, Jerome Powell. While some large sell-offs can surely be attributed to institutional and whale activity, the question still remains whether deeper institutional concerns are also at play.

Financial analysts warn that Trump’s move “marks an unprecedented moment for both central bank independence, signaling the White House’s escalating campaign to exert direct influence over monetary policy decisions,” with Edward Mills of Raymond James adding that “markets are likely to view this attack on Fed independence negatively, amplifying uncertainty over future policy direction.”

The Constitutional and Legal Battle

Cook has hired high-profile attorney Abbe Lowell and declared: “President Trump purported to fire me ‘for cause’ when no cause exists under the law, and he has no authority to do so. I will not resign.” Under the Federal Reserve Act, governors can only be removed “for cause”—meaning corruption or misconduct, not policy disagreements.

This sets up an unprecedented constitutional crisis that could drag on for months, creating exactly the kind of regulatory uncertainty that crypto markets hate. If Trump succeeds in removing Cook and getting her replacement confirmed, along with his nomination of Stephen Miran to fill another vacant seat, Trump would then hold a 4-to-3 majority of appointees on the board.”

Broader Implications for Digital Asset Policy

For the crypto industry specifically, this creates a troubling contradiction. Trump promised to make America the “crypto capital of the world,” and his administration has delivered significant wins: the Strategic Bitcoin Reserve, regulatory clarity initiatives, and an end to what the industry calls “Operation Choke Point 2.0”. But these achievements depend on the kind of stable, credible monetary system that his Fed interference directly undermines.

Why Fed Independence Matters for Crypto

The market turbulence validates concerns that Trump’s assault on Fed independence undermines the institutional credibility that makes his Strategic Bitcoin Reserve valuable. The crypto community that overwhelmingly supported Trump expected regulatory clarity and institutional support, not continual constitutional crises that undermine the monetary stability that gives digital assets their mainstream credibility.

The Global Context

The market reaction included predictions that Trump’s move represents “fiscal dominance” acceleration, with Joe Consorti, Head of Growth at Bitcoin focused firm Theya, warning that “Weimar beckons“—a reference to the hyperinflation that destroyed Germany’s currency when its central bank lost independence. While such comparisons may be extreme, they reflect genuine concerns about the precedent Trump is setting.

The crypto community that supported Trump expected regulatory clarity and institutional support for digital assets. Instead, they’re witnessing an assault on the institutional independence that makes reserve assets valuable in the first place. You cannot build lasting crypto adoption on the foundation of weakened institutions and political interference with monetary policy.

An Unpredictable Path Forward

Cook’s legal challenge will likely reach the Supreme Court, creating months of uncertainty about Fed governance and monetary policy independence. For crypto markets already dealing with regulatory complexity and institutional adoption challenges, this added layer of constitutional crisis represents exactly the kind of instability that drives institutional investors away.

Destroying institutional independence doesn’t strengthen America’s position in becoming the President’s crypto capital of the world proclamation. Quite the opposite. It makes America unpredictable. The market’s sharp negative reaction to the President’s shocking attempted removal of a Fed governor suggests that his crypto constituencies understand this fundamental truth. As bitcoin trades below $110,000 (its lowest level since early July) the message from crypto markets is clear: attacks on Fed independence are bad for the digital assets industry and could undermine the very institutional credibility that makes the President’s Strategic Bitcoin Reserve and digital assets stockpile valuable.